by Keith Huggett | Aug 31, 2017 | Blog

5 Tax Strategies for Small Businesses Simple Steps To Pay Less When you own or manages a small business you are often called upon to handle many different jobs all at the same time, the most import of which is to keep money flowing smoothly into the coffers. One way...

by Keith Huggett | Aug 29, 2017 | Blog

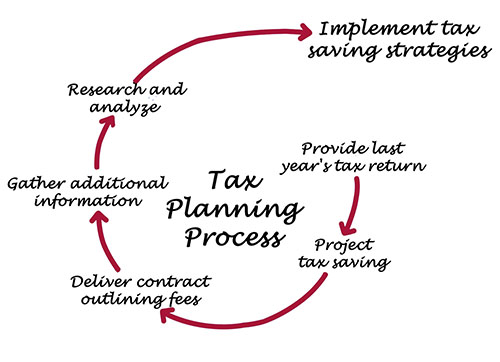

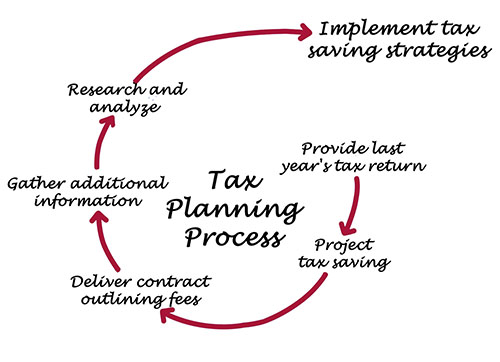

Why Midyear Tax Planning is a Smart Idea Being Prepared Can Save Money Most people only pay attention to taxes in April and at the end of the year, but spending a little time on mid-year tax planning can help your business save a bundle. If you wait until the last...

by Keith Huggett | Aug 24, 2017 | Blog

Why We Love Record Keeping (And You Should Too!) Do You Know Which Records to Keep? Keeping accurate records for your tax purposes is a must. Every year, taxpayers go through the irritating task of gathering the information needed to file their federal income tax...

by Keith Huggett | Aug 22, 2017 | Blog

Tips for Reconciling Your Accounts Keeping Up-to-Date Books Can Help You Spot Errors Have you ever wondered why reconciling your bank accounts is so important? By reviewing your transactions in your bookkeeping software and comparing them to your bank statements...

by Keith Huggett | Aug 15, 2017 | Blog

10 Reasons Every Business Needs a CFO Big Business, Small Business, CFO’s Provide Answers No matter what size your business is, it can benefit from the advice provided by a CFO. Whether you have just started up your company; if you’ve been in business for...

Recent Comments