Expense Categories for Small Businesses

Spending money is a requirement of running a business, do you ever wonder if those expenses are tax deductible?

Spending money is a requirement of running a business, do you ever wonder if those expenses are tax deductible?

Every year, when tax season comes around, do you spend hours sorting through receipts or organizing your expenses into useful categories because they’ve been lumped into one catch-all category? Do you send your bookkeeper a box of receipts and check copies?

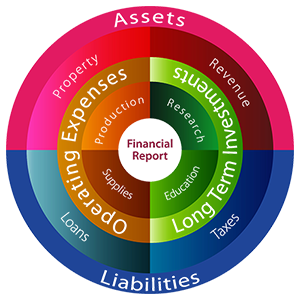

Business expenses can be confusing for new small business owners. To avoid confusion, you should set up expense categories for your business that are common to others in your industry. Expense categories allow you to easily sort and classify expenses as you spend money, saving you a lot of time by avoiding the hours of sorting boxes of receipts. If you happen to outsource your bookkeeping, categories also make it easier for your bookkeeper.

Here is a list of commonly used expense categories. While exhaustive, it is not necessarily complete. Some categories may not apply to your business.

- Advertising

- Bad debts

- Business start-up costs

- Business taxes, fees, licenses,

- Business-use-of-home expenses

- Capital cost allowance

- Current or capital expenses

- Delivery, freight, and express

- Dues, memberships, and subscriptions

- Insurance

- Interest

- Legal, accounting, and other professional fees

- Maintenance and repairs

- Management and administration fees

- Meals and entertainment

- Motor vehicle expenses (automobile)

- Fuel costs

- Office expenses

- Prepaid expenses

- Property taxes

- Rent

- Salaries, wages, and benefits

- Supplies

- Telephone and utilities

- Travel

- Other expenses

While it’s a good idea to break up your expenses into separate accounts, be careful about setting up too many categories. Remember, to keep documentation for all of your business expenses, regardless of the amount just in case of audit. It is your responsibility to substantiate all of the entries and deductions on your tax return. Maintaining receipts and other records to document your business’ purchases and sales is in your best interests.

Should this seem overwhelming to you, we can help. We can educate you on how to use your accounting software or we can do your bookkeeping for you. Contact us if you have any bookkeeping related questions. The bookkeepers at Next Level Accounting & Tax are available to answer your questions.