Education Tax Benefits

Take Advantage of Available Education Tax Benefits

If you pay tuition, fees, and other costs for attendance at an eligible educational institution for yourself, your spouse, or your dependent, you may be able to take advantage of one or more of the education tax benefits.

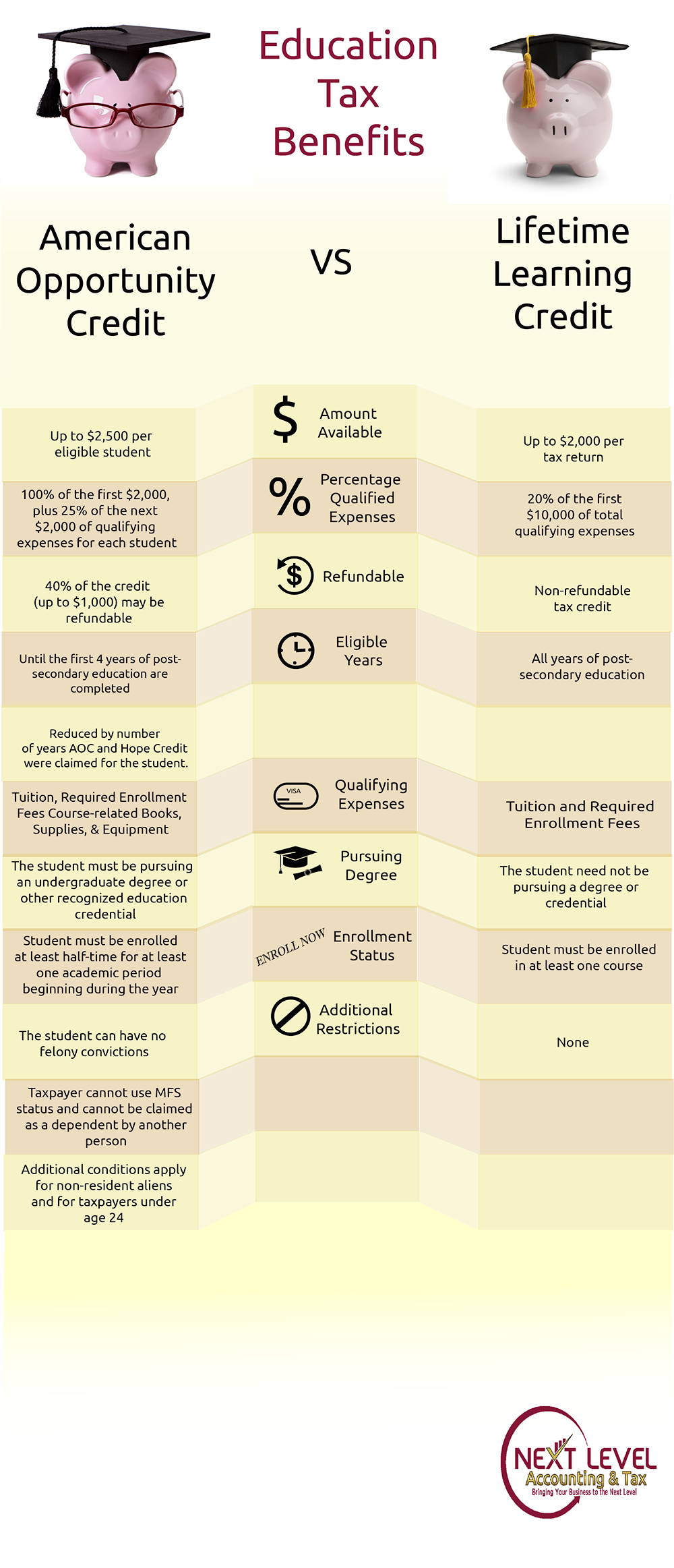

You may claim only one of the following education tax benefits for the same student per year: tuition and fees deduction, American Opportunity Credit, or Lifetime Learning Credit. Our helpful infographic highlights the differences between the American Opportunity Credit and the Lifetime Learning Credit.