You’ve spent the majority of your life working to save enough money so that you are able to retire. As you transition into retirement and start to live off your savings, it’s important to develop a strategy that helps manage retirement challenges such as longevity, inflation, and market volatility, and ensures your income lasts for life.

You may want to get your bearings and ask yourself where you are now:

How much will I need to retire?

Will Social Security be there?

Will my retirement income last as long as I live?

How can life insurance help supplement my retirement income?

Retirement Planning – Things to Consider

Unforseen Medical Expenses

Estate Planning

Inflation

Cognitive Decline

A foggier brain. Dementia. Alzheimer’s disease. These are big concerns and scientists are furiously working to find cures for cognitive decline.

Debt

Debt can be a constant source of stress and affect retirees’ ability to keep their homes, pay necessary living expenses, and even be accepted into independent- or assisted-living facilities.

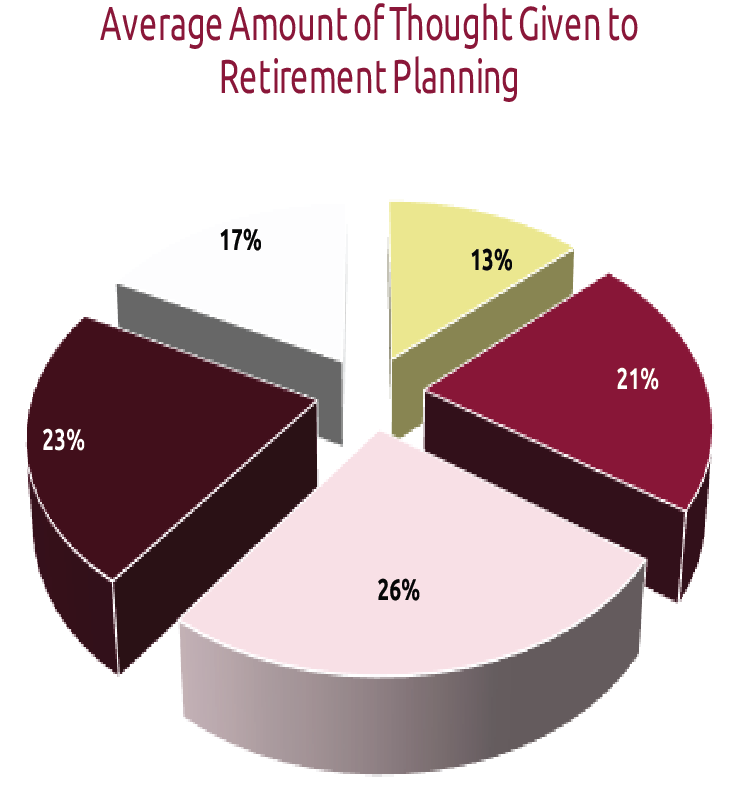

- 13% of Non-Retired Adults Give Retirement a Lot of Thought

- 21% of Non-Retired Adults Give Retirement a Fair Amount of Thought

- 25% of Non-Retired Adults Give Retirement Some Thought

- 22% of Non-Retired Adults Give Retirement a Little Thought

- 17% of Non-Retired Adults Give Retirement No Thought

Retirement can be about having the time to enjoy the things you have always wanted to do. Put your retirement concerns at ease by planning ahead and laying a good foundation for your financial security.

Contact Us!

Phone

(916) 960-9800

Fax

(916) 415-8273

2 Locations to Serve You

508 Gibson Drive, Suite 240

Roseville, CA 95678

31495 County Road 31

Greeley, CO 80631

Hours of Operation

8:00 am - 5:00 pm

Monday - Friday